The aviation industry stands at a precarious crossroads in late 2025. As global travel surges back to pre-pandemic levels, a parallel rise in climate consciousness has birthed a new era of scrutiny. For the modern traveler, the checkout screen option to “offset your carbon footprint” for a few dollars has become a moral litmus test. But does clicking that button actually save the planet, or is it merely a digital indulgence in guilt-free pollution?

- The State of Sustainable Aviation in late 2025

- The Greenwashing Epidemic: A 2025 Retrospective

- Verified Programs: The Gold Standard vs. Verra

- The Mechanics of a Valid Offset

- Trending Keywords and Concepts for the 2025 Traveler

- Financial Implications: The Cost of True Sustainability

- Actionable Advice for the Conscious Flyer

- Conclusion

This deep dive explores the volatile landscape of aviation carbon credits, the massive EU crackdown on airline marketing, and how to distinguish between genuine environmental investment and corporate greenwashing.

The State of Sustainable Aviation in late 2025

The narrative around sustainable travel has shifted dramatically over the last twelve months. We are no longer just talking about “eco-tourism” in a vague sense. We are discussing legal frameworks, court rulings, and hard data. The era of blind trust is over.

As of December 2025, the aviation sector is grappling with the implementation of the EU’s “EmpCo Directive” (Empowering Consumers for the Green Transition), which was formally adopted in 2024. This directive has effectively outlawed generic environmental claims like “climate neutral” or “eco-friendly” unless they are backed by rigorous, life-cycle verifiable proof. The days of an airline simply planting a tree and calling a flight “green” are legally numbered.

For the high-net-worth traveler and the budget backpacker alike, understanding where your money goes when you buy an offset is crucial. It is not just about charity; it is about the integrity of the supply chain.

The Greenwashing Epidemic: A 2025 Retrospective

To understand verified programs, we must first understand what they are fighting against: greenwashing.

In a landmark shift, 2024 and 2025 saw European consumer protection authorities launch coordinated investigations into over 20 major airlines. The core of the complaint? Misleading consumers into believing that paying a small surcharge could “neutralize” the massive carbon impact of burning jet fuel at 35,000 feet.

The “Phantom Credit” Scandal

Recent investigative reports have shaken the voluntary carbon market (VCM) to its core. Studies revealed that a shocking percentage of rainforest conservation credits—often used by major corporations to claim carbon neutrality—were “phantom credits.” These credits represented vegetation that was never in danger of being cut down, meaning the payment did not prevent any new emissions. It was money changing hands for a status quo that already existed.

Source Link: EU Actions Against Airline Greenwashing

The Legal Fallout

A pivotal moment occurred when a Dutch court ruled against KLM, stating that their “Fly Responsibly” campaign was misleading. The court found that the airline painted “too rosy a picture” of Sustainable Aviation Fuel (SAF) and reforestation. This set a precedent that is now rippling through the industry. Airlines are rapidly scrubbing terms like “offsetting” from their marketing materials, replacing them with more cautious language about “contributing to climate projects.”

Verified Programs: The Gold Standard vs. Verra

If airline checkboxes are unreliable, where should a conscientious traveler look? The answer lies in the third-party verification bodies that audit carbon projects. Not all tons of CO2 are created equal.

The Gold Standard (GS)

Established by the WWF and other NGOs, the Gold Standard is widely considered the “premium” benchmark in the voluntary carbon market.

- Focus: It prioritizes projects that contribute to the UN Sustainable Development Goals (SDGs).

- Why it matters: A Gold Standard project doesn’t just capture carbon; it might also provide clean water to a village or improve local health outcomes.

- Investment Value: Credits certified by GS often trade at a premium (20-40% higher) compared to others because they carry lower reputational risk for buyers.

- Verification: They require rigorous, on-the-ground auditing to ensure “additionality”—proving that the project would not have happened without the funding.

Verra (Verified Carbon Standard – VCS)

Verra is the largest program by volume, certifying billions of credits.

- Focus: Scale and volume. Verra is the giant of the industry, often used for large REDD+ (Reducing Emissions from Deforestation and Forest Degradation) projects.

- Controversy: Verra has faced significant heat regarding the methodology used for some of its rainforest projects. However, in response to the 2023-2024 criticism, they have been overhauling their methodologies to regain trust.

- Use Case: While controversial, they remain a massive player. If you are buying Verra credits, deep due diligence is required to see exactly which project methodology was used.

Source Link: Verra vs Gold Standard Comparison

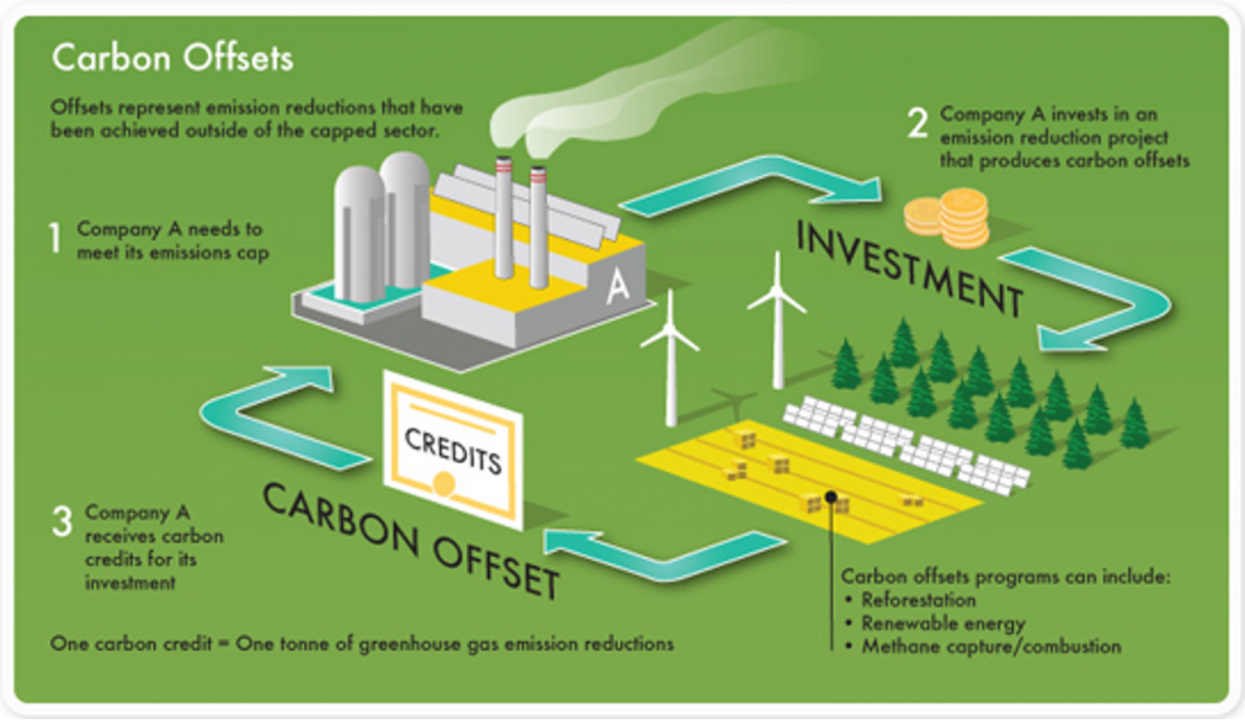

The Mechanics of a Valid Offset

To avoid throwing money into a black hole, investors and travelers must look for three non-negotiable criteria in any carbon project:

- Additionality: This is the most critical metric. Does your money fund a new reduction? If a wind farm was going to be built anyway because it is profitable, buying carbon credits from it is not “additional.” It is just subsidizing a profitable business.

- Permanence: Will the carbon stay out of the atmosphere? Planting trees is popular, but if that forest burns down in a wildfire ten years later (a growing risk), the carbon is released back. Geological sequestration (injecting CO2 into rocks) offers higher permanence than biological methods.

- Leakage Prevention: protecting one patch of forest is useless if the loggers simply move five miles down the road to cut down a different patch. High-quality programs monitor the entire region to prevent this “leakage.”

Trending Keywords and Concepts for the 2025 Traveler

The conversation is moving beyond simple offsetting. Here are the trending concepts defining sustainable travel right now.

Regenerative Travel

This is the buzzword of late 2025. It goes beyond “sustainable” (doing no harm) to “regenerative” (leaving a place better than you found it). This involves tourism dollars directly funding the restoration of coral reefs or the rewilding of agricultural land.

- Keyword Trend: “Regenerative tourism luxury” is seeing a spike in search volume as high-end resorts integrate conservation directly into the guest experience.

Sustainable Aviation Fuel (SAF)

SAF is the industry’s great hope. Made from cooking oil, agricultural waste, or even captured carbon, SAF can reduce emissions by up to 80% compared to jet kerosene.

- The Reality: Currently, SAF makes up less than 1% of global jet fuel.

- The Option: Some airlines now allow you to pay extra to cover the cost of SAF for your specific seat. This is far more effective than a tree-planting offset because it directly funds the fuel transition, though it is significantly more expensive.

Flight-Free Tourism

“Flight-free” has moved from a fringe movement to a mainstream travel category. High-speed rail networks in Europe and Asia are seeing record bookings.

- Keyword Trend: “Luxury train travel Europe 2025” and “Slow travel itineraries.”

Quietcations

In a noisy, digital world, silence is a luxury commodity. “Quietcations” focus on acoustic ecology—destinations that guarantee silence and freedom from noise pollution. These are often located in deep nature reserves, requiring strict environmental protection funded by tourism revenue.

Financial Implications: The Cost of True Sustainability

For the savvy individual, understanding the “price of carbon” is a financial literacy skill.

In the voluntary market, a “junk” carbon credit can cost as little as $2 per ton. These are widely regarded as useless for real climate mitigation.

A high-quality, Gold Standard verified removal credit (like biochar or direct air capture) can cost upwards of $100 to $500 per ton.

If an airline offers to offset your transatlantic flight for $5, they are almost certainly purchasing low-quality, avoided-emission credits. A true offset for a long-haul flight, using high-permanence removal technologies, would likely cost hundreds of dollars. This price disparity is the clearest indicator of quality.

Actionable Advice for the Conscious Flyer

If you must fly, here is the protocol for 2025:

- Ignore the Airline’s Checkbox: Do not buy the default offset. The transparency is rarely sufficient.

- Fly Direct: Take-off and landing are the most fuel-intensive parts of a flight. One long flight is better than two short ones.

- Sit in Economy: Business and First Class seats take up more space and weight, giving them a carbon footprint 3 to 4 times higher than an economy seat.

- Buy Direct from Source: Go to the Gold Standard or a reputable aggregator like “Cool Effect” or “Atmosphere.” Select a specific project—clean cookstoves in Kenya, wind power in India—and buy credits equal to your flight’s emissions.

- Support SAF: If the airline offers a “Green Fare” that explicitly purchases Sustainable Aviation Fuel, this is the most direct way to drive industry change, despite the higher cost.

Conclusion

The era of cheap, easy moral absolutions is ending. The “carbon offset” market is cleaning up its act, forced by litigation and consumer demand. For the traveler in 2025, the choice is no longer about blindly clicking a button. It is about becoming an investor in the planet’s future. Whether you choose to support a Gold Standard community project or purchase expensive SAF, the power lies in verification.

Greenwashing relies on consumer ignorance. By demanding transparency, additionality, and permanence, we force the market to deliver real solutions rather than marketing mirages. The skies may not be green yet, but the roadmap to getting there is finally becoming clear.

Source Links: